NSDL Database Management Limited (NDML)

|

NDML is a fully owned subsidiary of National Securities Depository Limited (NSDL) which is the first and largest securities depository in India and also runs various other critical applications. One of the major proven competences of NSDL is its ability to conceive, design, implement, manage and maintain large databases that can bring in transactional efficiency for common good. NSDL has also successfully set-up technology hub for managing these databases as well as a nation-wide foot-print of service centers where users of the system can be serviced. NDML will strive to provide the benefits of technological expertise, physical network and management experience of NSDL.

National Securities Depository Limited (NSDL)

|

National Securities Depository Limited (NSDL) is a company promoted by financial institutions of national stature which are responsible for economic development of the country. NSDL is promoted by Industrial Development Bank of India Limited (IDBI) - the largest development bank of India, Unit Trust of India (UTI) - the largest mutual fund in India and National Stock Exchange of India Limited (NSE) - the largest stock exchange in India. Some of the prominent banks in the country have taken a stake in NSDL. Some of the important systems managed by NSDL include

NSDL - Depository System

NSDL pioneered the concept of holding and settlement of securities (shares, debentures, bonds) in electronic form in India. NSDL has established a national infrastructure of international standards that handles most of the settlement of securities in dematerialised form in Indian capital market. This system provides for a safe and efficient form of holding the securities to millions of individual and corporate investors. Holding and settlement of securities in electronic form has considerably reduced the risk and time involved in dealing with paper form of securities.

NSDL aims at ensuring the safety and soundness of Indian market place by developing settlement solutions that increase efficiency, minimise risk and reduce costs. In the depository system, securities are held in depository accounts, which is more or less similar to holding funds in bank accounts. Transfer of ownership of securities is done through simple account transfers. This method does away with all the risks and hassles normally associated with paperwork. Consequently, the cost of transacting in a depository environment is considerably lower, as compared to transacting in paper certificates.

As on August 19, 2009, NSDL has crossed one crore investor accounts. These accounts have more than 80% of securities held and settled in dematerialised form in India, indicating preference and trust the investors have in maintaining their assets with NSDL. Over the period of last two years, more than 40 lakh new demat accounts were opened with NSDL. These accountholders are serviced by 281 Depository Participants through more than 9,600 service centres across about 1,000 cities/towns in the country. For latest statistics please visit www.nsdl.co.in

NSDL - Tax Information Network (TIN)

|

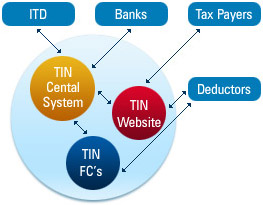

Various functions of TIN are

- Receiving and storing of TDS returns in electronic format (e-TDS).

- Receiving and storing of Tax Payment information (OLTAS).

- Registration of e-Return Intermediaries.

- Processing of applications for issuance of Tax Deduction Account Numbers (TAN).

- Processing of applications for issuance of Permanent Account Number (PAN).

- Collection and processing of Annual Information Return (AIR) from specified persons for specified transactions on behalf of ITD.

- Assesses can view the details of taxes paid and TDS deducted for them (based on PAN) on the internet.

For more details visit www.tin-nsdl.com

NSDL - Central Recordkeeping Agency (CRA)

NSDL has established a Central Recordkeeping Agency (CRA) for the New Pension System (NPS) on behalf of the Pension Fund Regulatory and Development Authority (PFRDA).

NPS was introduced by Government of India for its new employees (except the Armed Forces) w.e.f. January 1, 2004. NPS is an important pension reform for the old age financial security. The CRA is a first of its kind of venture in India and is critical to the successful operationalization of the NPS. Under the NPS, each new government employee will open an account with CRA which will be identified through unique Permanent Retirement Account Number (PRAN). In this system, deductions will be made from employee's salary on monthly basis and equal amount of contribution will be made by the Government. The amount will get invested through PFRDA appointed Pension Fund Managers (PFMs). The accumulated amount will be reflected in employee's Permanent Retirement Account while employee is working and shall use the accumulations at retirement to procure a pension for the rest of the life. Subscribers in this system shall enjoy certain facilities and rights including portability across jobs and locations, choices of selection of Pension Funds and investment schemes, freedom to switch between service providers and nationwide access.

CRA plays a crucial role in ensuring the operational efficiency of the system. The main functions and responsibilities of the CRA include Recordkeeping, administration and customer service functions for all subscribers of the NPS.

Issue of unique PRAN to each subscriber, maintaining a database of all PRANs issued and recording transactions relating to each subscriber's PRAN.

Acting as an operational interface between PFRDA and other NPS intermediaries such as Pension Funds, Trustee Bank, Annuity Service Providers etc.

CRA will monitor Subscriber contributions and instructions and transmit the information to the relevant Pension Funds and schemes as per the guidelines laid down by PFRDA. CRA will provide annual consolidated Statement of Transactions to each Subscriber and discharge such other duties and functions as may be determined by the guidelines, directions and regulations issued by the PFRDA from time to time.

CRA is also providing electronic interconnectivity to PFRDA, other linked entities like Trustee Bank, Pension Funds and Annuity Providers.

From May 2009, PFRDA has opened the participation in NPS scheme to all citizens of the country so that every person (age group 18 - 55) whether employed or in business or otherwise can open a pension account with NSDL CRA and accumulate his/her savings to provide for old age security.

More details about the system can be accessed through the CRA web-site http://www.npscra.nsdl.co.in.

NDML - National Skills Registry (NSR)

National Skills Registry (NSR) is set-up and managed by NDML on behalf of NASSCOM (www.nasscom.in) NASSCOM is India's National Association of Software and Service Companies, the premier trade body and the chamber of commerce of the IT software and services industry in India. NASSCOM is a global trade body with over 1200 members. NASSCOM's member companies are in the business of software development, software services, software products, IT-enabled / BPO services and e-commerce.

National Skills Registry is a NASSCOM initiative to have a robust and credible information repository about all persons working in the industry. This develops trusted and permanent fact sheet of information about each professional along-with background check reports. This is a security best practice for the industry and assures identity security, industry acceptance to honest professionals.

NSR is a web-based system hosting a fact sheet of information about existing and prospective employees of Indian IT & ITeS / BPO industry. This can be used by the IT & ITeS / BPO industry and its clients as a credible source of information about the registered professionals who are being employed or put on client assignments. The system will also enhance the image of Indian IT & ITeS / BPO industry as one that has raised the bars on security standards in pursuit of excellence and client satisfaction. This will promote industry's claim for bigger share of global business on one hand and will reduce the cost of repetitive background checks on professionals, on the other hand.

Considering that NSR is positioned well to serve a process and interest that is common and applicable to all organized, security conscious businesses, NASSCOM and NDML have agreed to extend the benefits of NSR initiative to Banking & Finance industry also.